Interest – Is the amount of money you pay to borrow money or the amount of money you get paid for depositing money

To remember what interest means use the following mnemonic:

I paid no interest (interest) to the small print about the monetary charge for borrowing money.

Sometimes a company will have some money in the bank from a profitable job. The money will be deposited into the bank and the bank will give the company a very small percentage, say 1% per year of the total amount in the bank.

In this example, if you have £1200 in the bank, they will pay 1% a year or £12 extra, meaning your total at the end of the year would be £1212.

If a company borrows £500,000 from the bank to buy a factory, the bank will charge you an annual rate, which could be at an interest charge of 6%. In this example, you would be charged £30,000 per year by the bank. There would be an additional amount added on to pay some of the principal sum off (the £500,000) of approximately £25,000 per year. Therefore, the company would have to find £55,000 per year to pay for the building.

There are, however, different interest charges that a business needs to be aware of, such as:

Nominal Interest Rate

For example, when a business borrows £10,000 over 1 year at an interest rate of 5%. £10,000 over 1 year at 5% would cost £500.

Effective Interest Rate

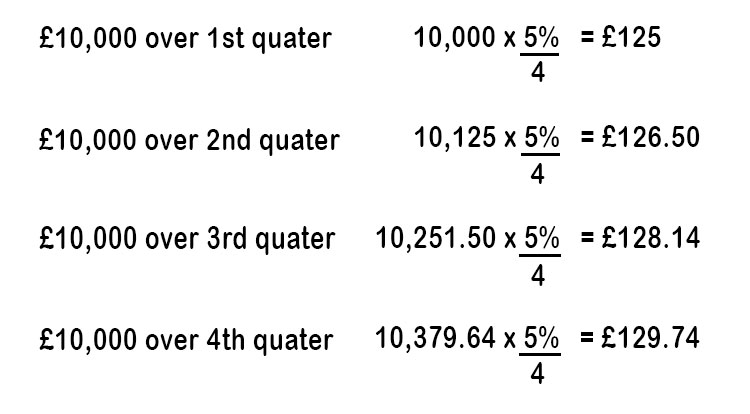

For example, when a business borrows £10,000 over 1 year but it is compounded quarterly (charged quarterly) at an interest rate of 5%.

Total Interest paid in a year = £509.38

This is effectively a yearly interest charge of 5.095%

If a business were charged monthly instead of quarterly, the effective yearly interest rate would be 5.116%

If a business were charged daily, the effective yearly interest rate would be 5.127%

Annual Percentage Rate (APR)

This takes the same calculation as above (i.e. the effective interest rate) but adds any charges made by a bank in setting up a deal. This could be £200 and must be converted into a percentage equivalent charge. If there are no fees then the APR equals the effective interest rate. Note: It is law in many countries that any advertising or deals signed must include the percentage APR so that any business or consumer can compare one product to another easily.

Fixed and Variable Interest Rates

Businesses mainly borrow money in two ways, either at a fixed interest rate or at a variable interest rate.

A fixed rate of interest would be to agree to fix the interest rate at the same amount every year for say a period of 3 years. This will help to take away any uncertainty or risk for the business, but you will pay more than the current interest rate if the loan was taken for a year.

A variable rate of interest is an interest rate that would fluctuate depending on the country’s inflation rate. It’s riskier because inflation and therefore the charges the business incurs can go up quite quickly, but they can also decrease.

(Note: a company with a poor credit rating and a history of not paying their debts on time will always be charged at a higher rate).