Mortgage – A type of loan to purchase property or land

(Pronounced maw-gij)

Note: This type of loan gives the lender the right to take your property if you fail to repay the money.

Note: Sometimes a mortgage is taken out on a property to release cash for other ventures.

To remember what mortgage means use the following mnemonic:

The morgue fridge (mortgage) contained the robber. Robbing banks is not the way to get money to buy a house.

Most businesses cannot afford to buy a new property outright so will need to borrow the money from a bank. This is called a mortgage.

If you ask for a mortgage from a bank, they will have the property valued. This valuation is usually less than the asking price. The bank will also not loan 100% of the valuation. It would rarely be over 80% and sometimes can be as low as 60% of the valuation. The company would normally have to find at least 25% of the asking price. This 25% is called a deposit.

This deposit is a safety margin for the bank. If the business fails to make the monthly payments (called a default) the bank can re-possess the property and have enough money in the property to make a sale within six months. There is also enough safety margin in the deposit to take out any costs incurred for the bank in selling the property. If there is anything left it goes to the business.

There are two main types of mortgage, fixed rate mortgages and variable rate mortgages.

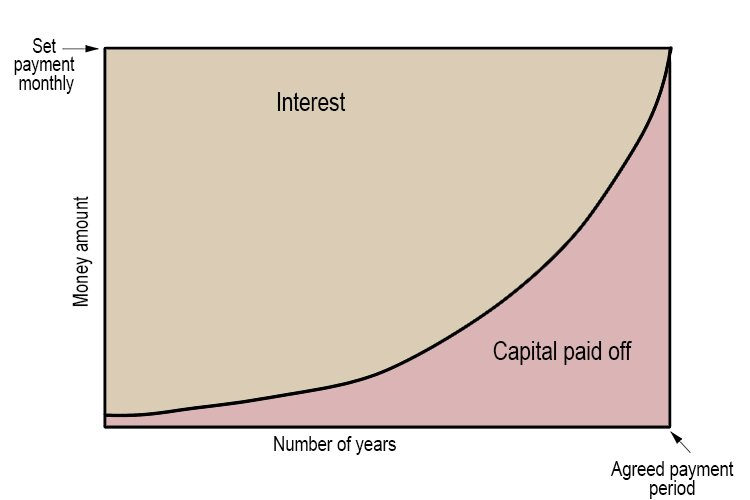

A fixed rate is where the amount you pay is the same every month for a set number of years and doesn’t move regardless of what happens to the nation’s base interest rate. The agreed term is usually any multiple of 5 years right up to 30 years. Early on, a business will be paying mainly interest on the loan and only at the end does the capital portion of the payment steadily increase, while the interest portion drops.

A variable rate or tracker rate is a mortgage which takes the current base interest rate and adds an agreed interest percentage on top of this. If you agree 3% interest above base at the end of each month then the amount you pay will be as follows: Base rate 2% and interest 3%, so you will pay for that month 5% interest on the outstanding capital (divided by 12 because it’s monthly). Often a company will pay an additional sum monthly or yearly to reduce the capital sum owed.

If the base rates go up so too will your mortgage payments for this month.

Some banks will agree for the company to only pay the interest on the loan, but it does mean you have to pay the entire loan at the end of the mortgage term (unless you can renegotiate again).

Choosing which type of mortgage depends greatly on whether you need the security of a set amount each month, but are likely to pay more (fixed rate mortgage), or, you can accept variations at the risk of jumps in payments, but in the long term you are likely to pay less (variable rate mortgage).

Both the fixed and variable charges from the bank depend on a company’s credit score. If a company has a great track record for paying all their loans on time, then they are a low risk and will gain a very favourable mortgage deal. If you have only just started and have very few assets then you are unlikely to gain a favourable rate and will pay a higher percentage monthly rate.

Mortgages can be a great way to finance the purchase of a commercial property. However, they are a long-term commitment and business should carefully consider their financial situation before taking out a mortgage.

Here are some benefits of a business getting a mortgage:

- You can purchase commercial property which can be a great investment while also providing the business with a better place to operate.

- You can build equity as you make monthly payments on the mortgage, you will then build up ownership in the property. You will have future access to this equity if you need to borrow money against it in the future.

However, here are some risks of getting a mortgage for a business premises:

- You could lose the property if you default on the mortgage. The bank can sell the property to recoup their money.

- You could find yourself in negative equity. This happens if the value of the property falls and the remaining amount left to pay on the mortgage is more than the property is worth.

- There are many fees that can add up when getting a mortgage, including legal and survey fees, stamp duty and moving costs.