Profit – The difference between the money received from the sale of goods/services and the amount that remains after all costs have been paid

(Pronounced prof-it)

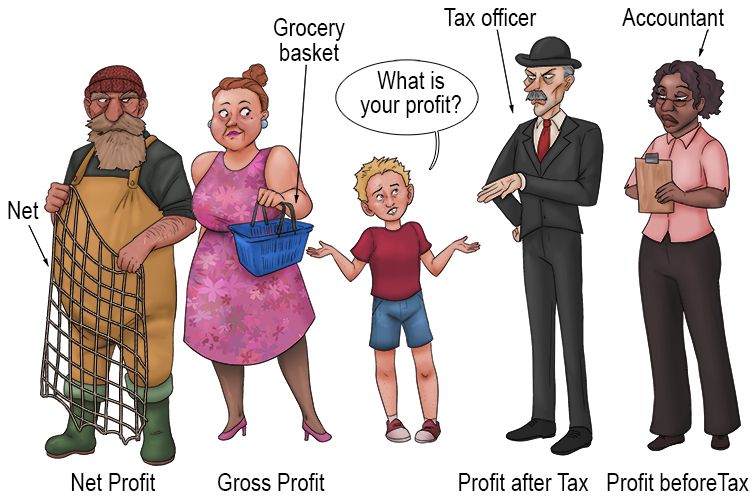

We know the profits are when somebody pays you for cleaning their car, but if you walk into a business and you ask the accountants what the profits are, they will look at you bemused.

You can not just say, "What are the profits" without being more precise. You need to ask for one of the following:

Gross profit

Net profit

Operating profit

Profit before tax

Profit after tax.

It’s strange how net profit can be changed very quickly by changing the depreciation rate on a piece of machinery. This is what accountancy firms discuss most in any final profit figure. Here’s an example:

If a company buys a delivery vehicle for £100,000 and decides to depreciate it (take it to zero value) after:

i/ 5 years, then each year the vehicle loses £20,000/year.

ii/ 10 years, then each year the vehicle loses £10,000/year.

This has quite an influence on the final years profit of the company.

5 years depreciation

Net profit so far = £15,000

Less 1 year of 5-year depreciation = - £20,000

Company profit = - £5000

10 years depreciation

Net profit so far = £15,000

Less 1 year of 10-year depreciation = - £10,000

Company profit = £5000

Now tell us what the net profit (after tax) is?