Statement of Financial Position (balance sheet) – another term for a balance sheet; a document that reports the assets, liabilities and shareholder's equity of a business; a financial document of how much a company is worth

To remember what statement of financial position means, use the following mnemonic:

This written statement says the financial position (statement of financial position) of the business is strong. The company is worth a lot of money.

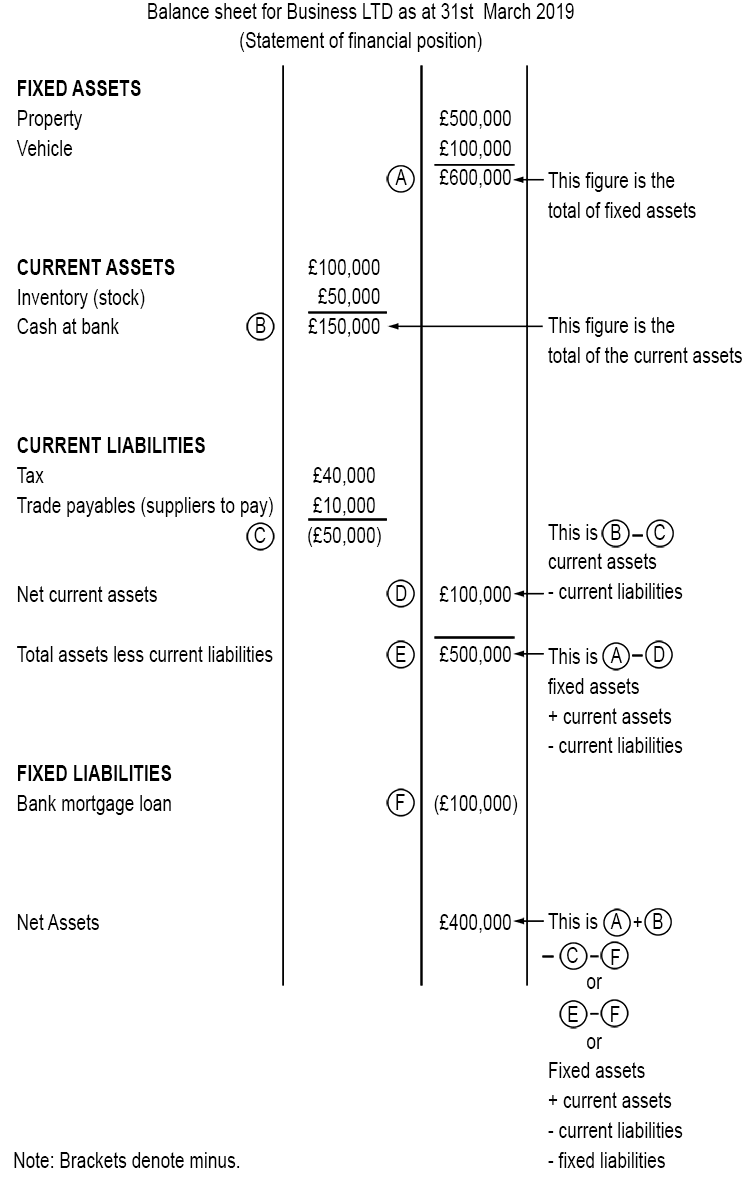

A statement of financial position, also known as a balance sheet, is a financial statement that summarises a company’s assets, liabilities and shareholder’s equity (net assets). At the end of each financial year, every limited company must send an income statement (profit and loss) along with this statement of financial position (balance sheet) to the government within the following 9 months. This balance sheet must be set out in a set format (see below).

The statement of financial position (balance sheet) is a snapshot of exactly how much a company is worth at a specific point in time. It shows what the company owns (assets), what it owes (liabilities), and the difference between the two (equity or net assets). This information can be used by investors, creditors and other interested parties to assess the company’s financial strength and ability to repay its debts.

If you are a business owner it is important to understand the statement of financial position (balance sheet) and how to interpret it, as the information is essential for making key decisions to achieve goals.

A breakdown of the key elements of a statement of financial position (balance sheet) are as follows:

- Current assets: These are assets (what you own) that can be converted into cash within a short period of time. Examples include inventory (stock) and cash itself.

- Fixed assets: These are long-term assets (what you own) that cannot be converted into cash as quickly. Examples include property and machinery.

- Current liabilities: These are liabilities (what you owe) that must be paid in full within the near future. Examples include accounts payable (suppliers), wages and taxes.

- Fixed liabilities: These are liabilities (what you owe) that can be paid off over a longer period of time. Examples include a mortgage on property, a finance arrangement on a piece of machinery or a bank loan.

- Net assets: This is essentially the net worth of a business. It can be calculated by working out the difference between total assets and total liabilities.