boston box – a tool for analysing the contribution made by each product in a business's product portfolio; is it a question mark, a star, a dog, or a cash cow?

(Pronounced bos-tuhn)

(This is also known as the Boston matrix or growth-share matrix)

To remember what Boston box means use the following mnemonic:

My boss has asked me to bring in a ton of these boxes (Boston box). When we opened one up we found, strangely, four statues, a bright star, a dog, a cow with money in it's mouth, and a question mark.

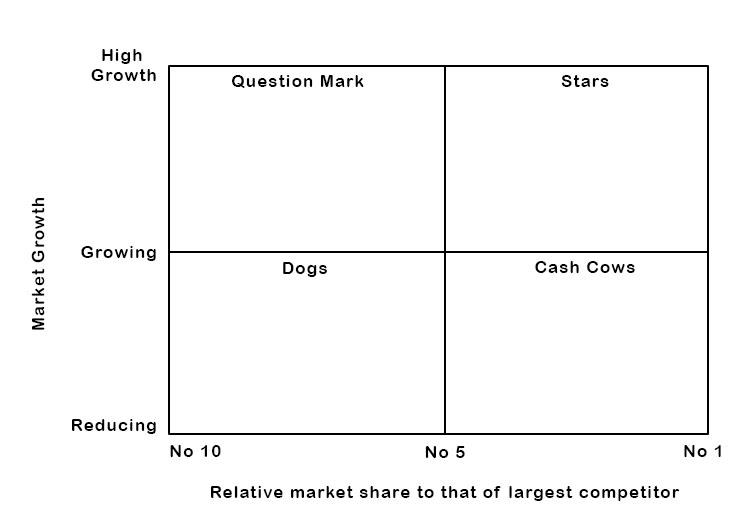

The Boston Box was developed by the Boston Consulting Group in the 1970s to analyse where best to invest in a large company’s product portfolios. They considered the degree of market share and market growth to help identify where best to use resources.

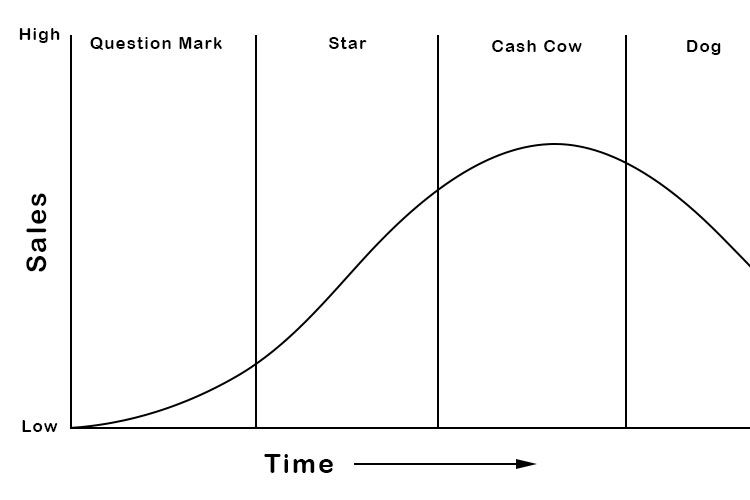

Below is a typical life cycle of a product’s sales over time:

The Boston Consulting Group then compared that to a product’s market position and came up with the Boston Box.

You can then place each of a company’s products into the box.

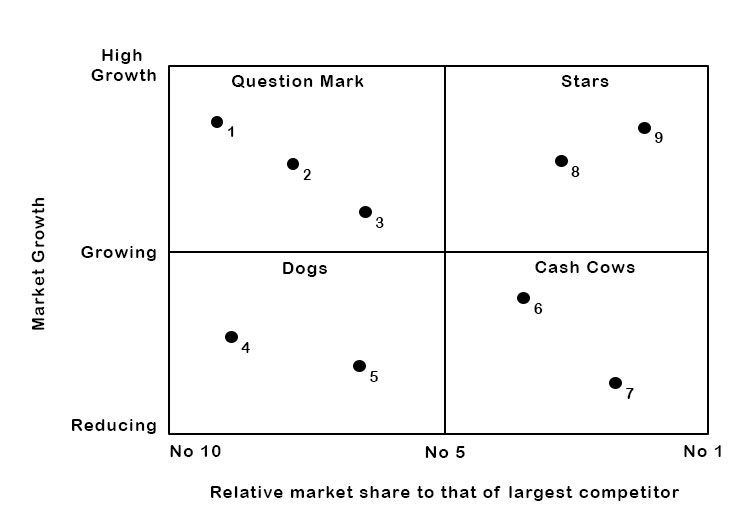

Dog (4 and 5)

If a company’s product has a low market share and the product category is in decline because of new technology, it’s unlikely that products 4 and 5 are creating much profit or cash. They are considered dogs and perhaps should be sold, liquidated or rethought. For this reason, products 4 and 5 are prime candidates for divestiture.

Cash Cows (6 and 7)

Products 6 and 7 are in low or reducing growth but have relatively large market shares. These generate profit and don’t need too much investment to keep going. While it’s bringing in profits, the money should be used to invest in the stars.

Stars (8 and 9)

Businesses and products in this quadrant are seeing rapid growth. There should be some worthwhile opportunities here and companies should invest here to realize their full potential.

Question marks (1, 2 and 3)

These are opportunities that require a lot of discussion because they haven’t been managed well so far. They can consume large amounts of cash and company resources to try and get them to be star products. It may only be possible for the company to choose one of the products and sell off or remove the other question marks.

Disadvantages of the Boston Box

There are limitations of a Boston Box analysis and it cannot possibly give a complete picture of each product’s potential.

A dog product doesn’t mean that the product isn’t profitable. Sometimes dog products are important to keep because they enable access to customers, which allows you to sell them more profitable products. Sometimes companies want to buy all their products from one company. If you’re making money from the dog itself and it helps you sell other products, you definitely want to keep the dog.

For example, if you are a graphic designer, you may create event flyers which you make very little money from. However, this allows you to also offer more profitable services to the client such as branding redesigns or merchandise, so keeping the flyer design service (the dog) is worth it.

Some products may be extremely profitable despite having both low market share and being in a slow growing industry. These should be kept.